This page is mainly for

(1) Non-Japanese nationals (including permanent residents) residing in Japan, and

(2) Non-Japanese nationals (including permanent residents) who do not reside in Japan but have assets in Japan.

This page is mainly for

(1) Non-Japanese nationals (including permanent residents) residing in Japan, and

(2) Non-Japanese nationals (including permanent residents) who do not reside in Japan but have assets in Japan.

Yes.

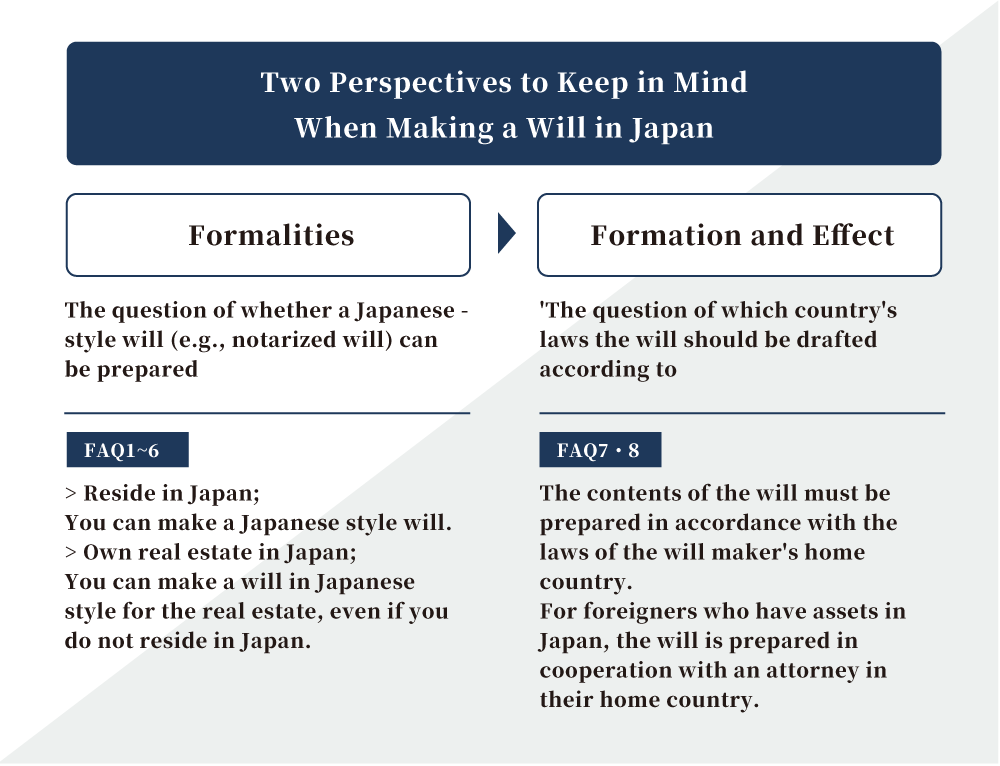

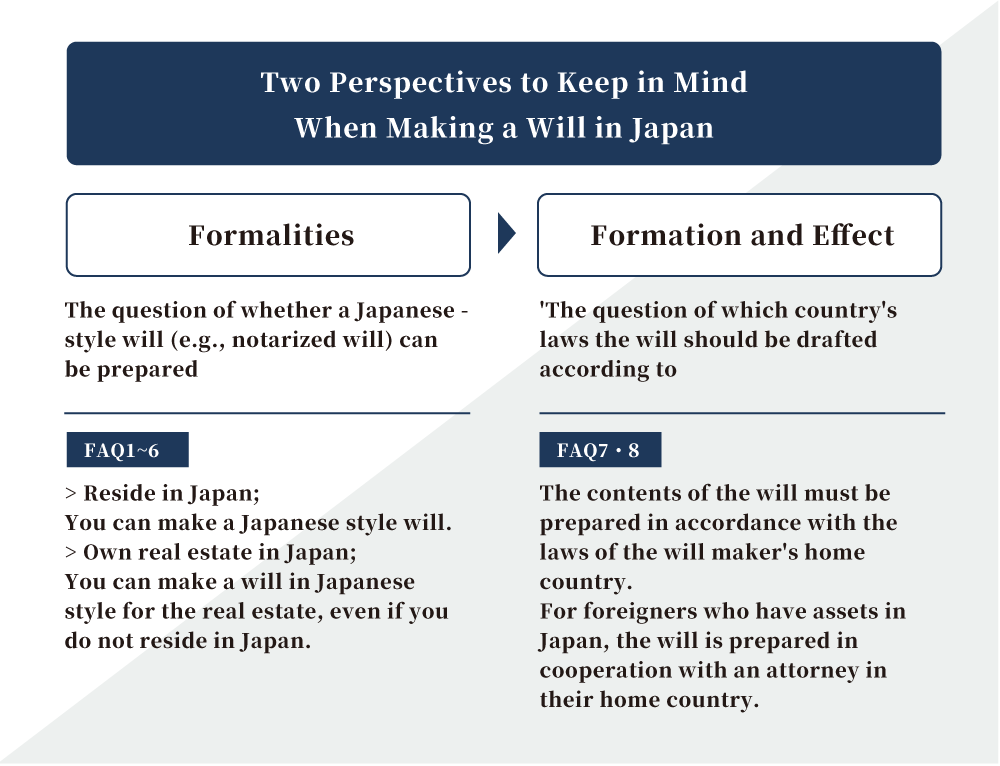

Yes. You do not need to be naturalized or obtain permanent resident status to make a Japanese-style (notarized) will. However, the will should be made according to “National Law” (In general, National Law means a law in your home country.). ⇒ Q7

Yes. However, since notarized wills are only made in Japanese, an interpreter must be provided.

Yes. However, identification such as a passport of the relative is generally required.

Yes.

However, I do not recommend making a handwritten will for the following reasons;

(1) A handwritten will may not be properly executed.

When executing a handwritten will, it is necessary to go through a procedure called "Kenin/検認" as required by Japanese law. This procedure requires all heirs to go to court to open and examine the will in front of a judge (a fine may be imposed if the will is opened without this procedure). However, since it is very difficult to investigate and identify heirs in a foreign country, the will may not be executed after all.

*Searching for heirs in foreign countries is very difficult because few countries have a system like the Japanese family register system.

(2) Another procedure “Probate” may be required in your home country.

If you have assets in Japan and your home country, the inheritance may take a very long time to be completed due to the need to go through the probate process in the home country, which is separate from the “Kennin” in Japan.

(3) The risk of forge etc.

There is a risk that a handwritten will may be forged or may not reflect the intention of the testator, and the validity of the will may be disputed among heirs after the death of the person testator.

By designating an executor (such as an attorney) in the will, the executor will properly execute the will.

It should be prepared in accordance with the laws of your home country. In this case, since Japanese attorneys are not familiar with foreign inheritance laws, it is necessary to research whether the contents of the will violate the laws of your home country, or to prepare the will in cooperation with the attorney in the home country.

*If you have Japanese nationality, your will should be made in accordance with Japanese law.

First, a will should be prepared in accordance with the laws of your home country by an attorney in your home country, specifying to whom and how all of your property (property located in your home country and in Japan) is to be inherited. Next, a Japanese-style (notarized) will should be prepared that contains the same provisions regarding property located in Japan that are stipulated in the will prepared in accordance with the laws of your home country.

Please note cases that are dedicated only for visas are not acceptable.

Your request has been accepted.