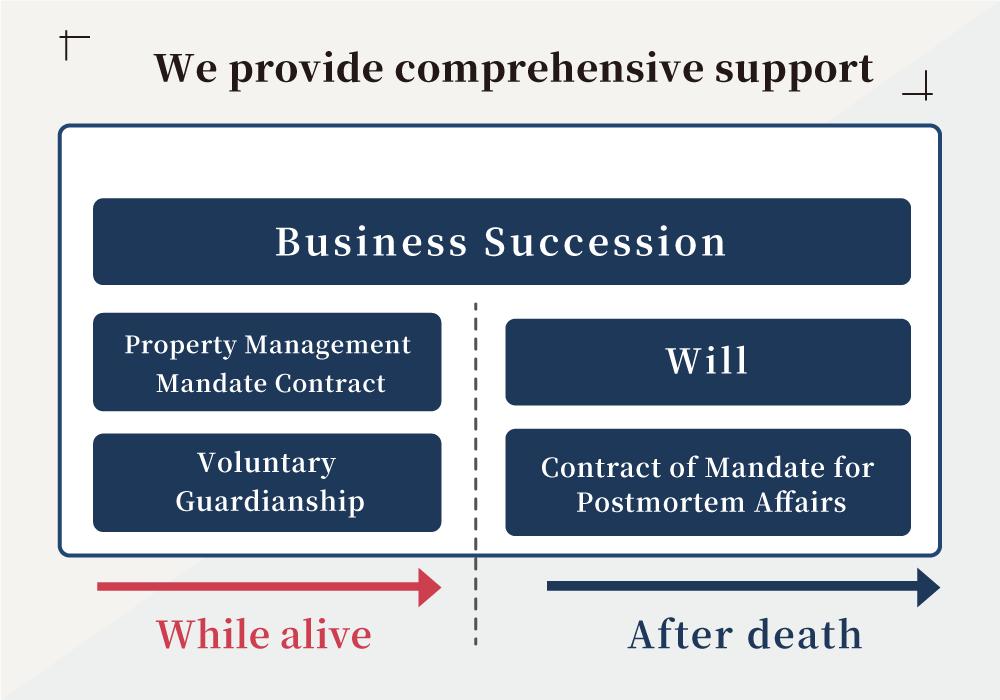

Business owners and managers may be concerned about the impact of their impaired judgment to the business and / or the company. We discuss what to be considered in order to resolve such concerns, focusing on business succession.

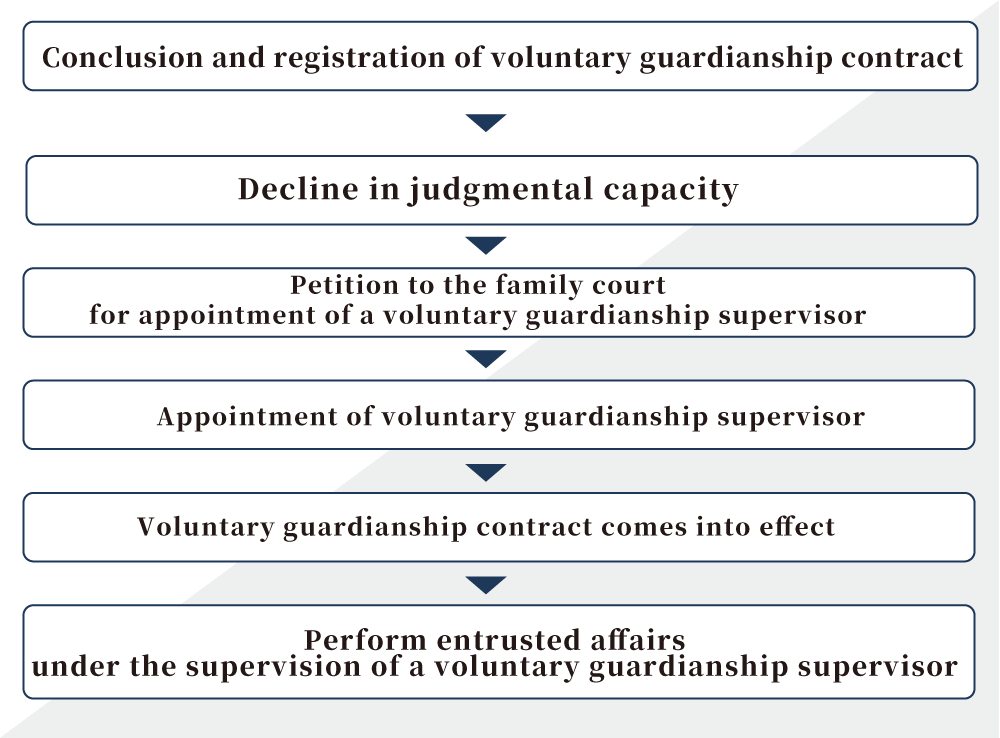

Generally, if a (representative) director of a company is determined to be an adult ward or a "person under conservatorship" due to impaired judgment or other reasons, the person is required to resign as a director. If there are other directors, new (representative) director will be appointed from among those directors.

The problem arises when the director is the only director and is also the sole shareholder (100% owner) of the company. Similarly, the director must step down. A new director must be appointed by shareholders at a shareholders' meeting. The trouble is that because the (sole) shareholder lacks capacity to vote, there is no way to appoint a new director.

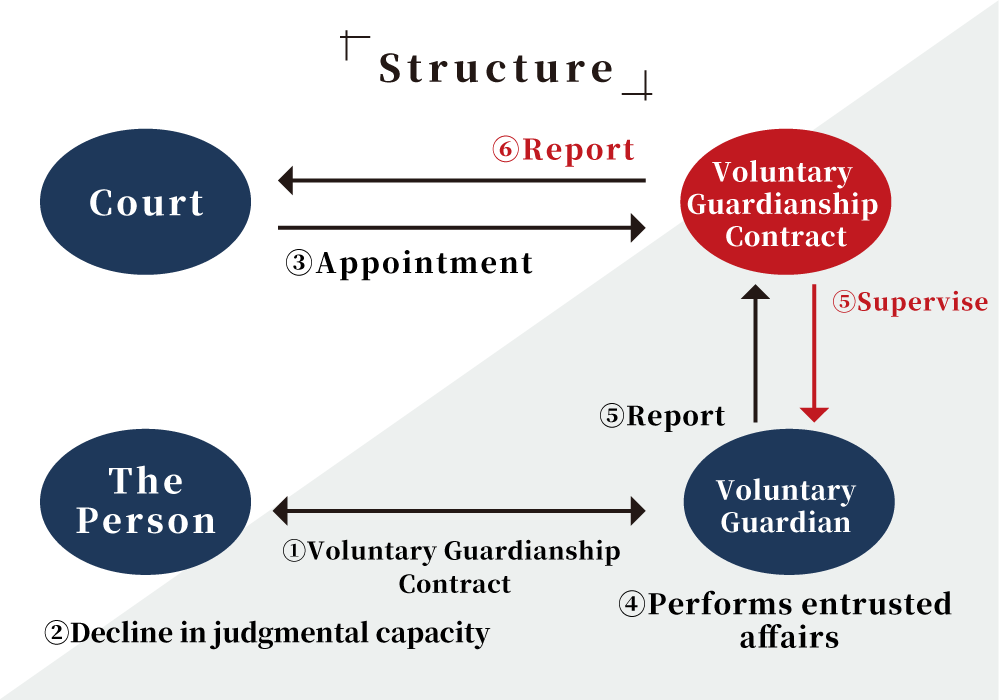

A possible solution is that the family of the former director-shareholder petition for an appointment of a legal guardian, and the appointed guardian exercises the voting rights to appoint a new director on behalf of the ward (former director-shareholder). However, it is highly doubtful whether the legal guardian has managerial knowledge to select a suitable successor as a director.

Without appropriate measures, management of a company will be exposed to serious risks. To mitigate such risks, owners and directors should be prepared for a business succession well ahead of time.

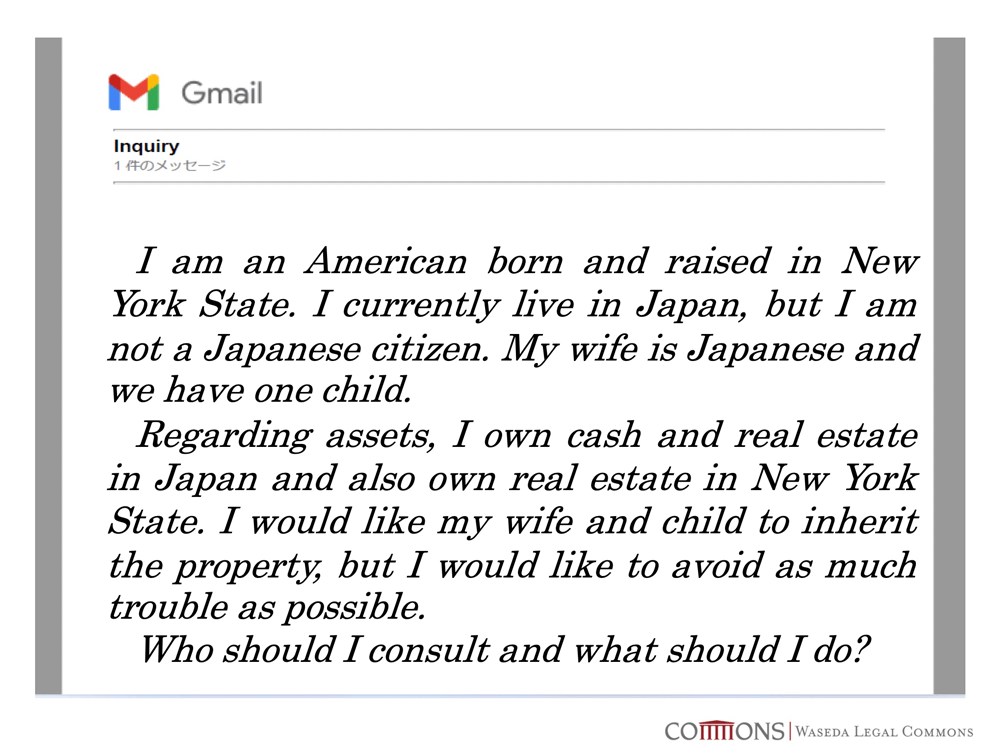

A business succession is carried out on a case-by-case basis, but common issues are the following.

1. Selection and training of a successor

2. When and how to transfer shares to a potential successor

3. Whether to maintain control of the company (e.g., by issuing golden shares)

4. Whether to receive preferred dividends

5. Whether to sell the shares to a third party (M&A)

In regard to 2. "when", options are immediate transfer, transfer in calendar-year method, and transfer by inheritance in a will, etc.

In terms of 2. "How", sale, gift, and transfer as compensation are the choices. As taxation is a major issue in transfer of shares, a succession plan should be developed in cooperation with a tax accountant.

As to 3. and 4., the shares must be designed so that the wishes of the owner and directors are realized.

5. "M&A" is an alternative considered under situations like lack of successors. Since it requires calculations of corporate value (valuation), M&A also should be carried out with assistance of accountants and tax accountants.

We work in cooperation with English-speaking tax accountants to effectively plan and execute business successions. If you are interested, please contact us.